Check Insights - Posts

How Hologram Checks Improve Security

Holograms on checks are of the latest check security measures. They are being used to help curb check fraud. Counterfeiters can scan checks with ease. Then they can print modified versions.

Hologram checks make it much more difficult to copy checks. Which increases security.

What Are Hologram Checks? Hologram check suppliers print the checks with a secure, “three-dimensional” reflective image - a hologram. The hologram is placed somewhere on the face of the check.

How Can I Print My Own Checks?

One of the most common reasons why the question “how can i print my own checks?” arises is because not all checking account holders use the same amount of bank checks.

Those who use a few checks a year would want to print their own checks. Since this would save them some money. Being able to print their own gives them cheaper checks rather than having to order a large amount .

Why Order Your Checks Online

As with most other things that you need to do these days, you can order personal checks online.

You can do most transactions electronically, but there are still times when you need a check. Such as for paying the day care provider, paying the Girl Scouts for a cookie order, or the unusual business that operates on cash or checks only. Yes, there’s still a few of them out there!

How To Write a Check

Learning how to write a check is essential for when you finally open a checking account. Used to pay for goods, services, and many other things in your life, knowing how to write one up properly can also save you valuable time and money.

Write one up the wrong way, and you might end up at the bank trying to straighten out a discrepancy or explaining a bounced check. It’s up to you to make sure your personal checks don’t end up this way.

Check 21: 8 Questions Of Importance

The law Check 21 or also known as the Check Clearing for the 21st Century Act was signed on October 28, 2003, and put into effect the same date the following year. This means that all provisions have been in effect from that day forward. The implementation will foster innovations in the existing payment system as well as enhance the efficiency through the reduction of some legal impediments associated with check truncation.

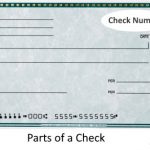

12 Parts Of A Check

Majority of Americans who have an existing checking account are not really quite aware about the different parts of a check. This means that either they are not fully aware or they just do not bother to find out what these parts are. Knowing the various parts actually can help checking account holders to properly read and understand how the bank checks are formatted.

Comprehending the individual parts can also be useful in ensuring that all transactions are properly completed.

9 Useful Check Security Features

There is no question about the importance of check security features that cover every transaction of checking account holders. This is further highlighted by the fact that according to Ernst & Young, there are over 500 million checks that are forged yearly amounting to losses approximating more than $10 billion. This has been upheld and substantiated by the American Banking Association with the added information that the alarming level rises at a rate of about 25% annually.

6 Options For Endorsing Checks

Banking institutions require recipients of checks to endorse the bank note before it is cashed or deposited to their account, which is why it is important to know the different options for endorsing checks. This is required for both personal and business checks. By definition, a check endorsement refers to the placement of the signature in the front or back of a bank check as a form of acknowledgement from both parties that an agreement for the exchange of a specific amount has been reached.

Are Travelers Cheques on a Terminal Decline?

In this technologically advanced age, people are increasingly making use of debit and credit cards to take care of travel expenses instead of relying on traveler’s cheques. They have declined more than traditional checks. With greater ease of access and security to electronic money, traveler’s cheques no longer provide the same ease and security they once did, hence their decline.

While their use may be declining, traveler’s cheques are by no means extinct.